Do you lack access to an employer-sponsored 401k and wonder if your chances for a secure retirement are at risk? The 401k plan has long been considered the most important retirement savings vehicle. However, for many people in the United States who do not have this option, having confidence that they can still have a safe retirement is important.

Retirement savings plans like a 401k are helpful, but other ways exist to ensure a comfortable retirement. This guide will walk you through several practical alternatives, outlining how to save for retirement without a 401k.

We try to equip you with the knowledge and tools to build a robust retirement savings plan tailored to your unique financial situation.

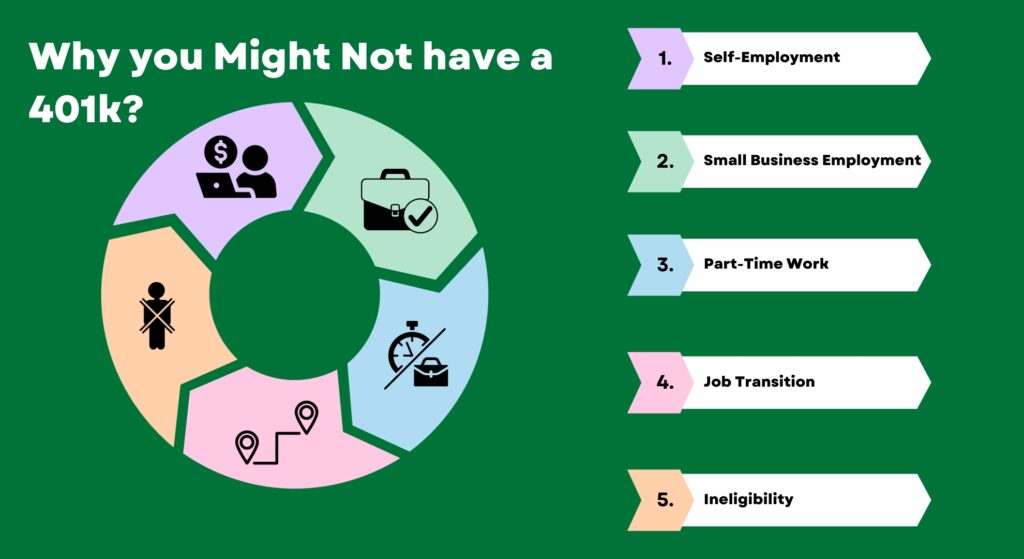

Why Might You Not Have a 401k?

Access to a 401k is often contingent on your employment situation, among other factors. While it’s a popular vehicle for retirement savings, it’s only sometimes available. Here are some common scenarios where you might find yourself without a 401k:

Self-Employment

Freelancers and business owners typically don’t have employer-sponsored 401k plans. In this case, a traditional IRA or Roth IRA could be a viable alternative for accumulating retirement savings.

Small Business Employment

Not all small businesses offer a 401k as part of their benefits package. Tax-deductible accounts, like traditional IRAs, can offer similar advantages for employees.

Part-Time Work

Part-time employees are often excluded from 401k eligibility by their employers. Roth IRAs and Traditional IRAs can be a good approach in such cases, as these accounts are used for alternative retirement savings vehicles.

A health savings account (HSA) can be another viable option. HSAs are designed primarily for medical expenses but can also be a strategic tool for retirement savings, especially when combined with other retirement instruments like a Roth IRA.

Job Transition

When you’re between jobs or planning a career change, your access to a 401k may be temporarily interrupted. Keeping your retirement savings on track through other avenues becomes crucial during these gaps.

Ineligibility

Some companies impose a waiting period or have specific requirements before employees become eligible for a 401k. If you’re in this boat, consider alternative options to continue bolstering your retirement fund.

How to Save for Retirement Without a 401K?

Navigating a secure retirement doesn’t have to be tied to a 401k. We’ll explore multiple roads for building a robust retirement fund without reliance on an employer-sponsored plan. From individual retirement accounts like traditional and Roth IRAs to alternative investment options, we’ll provide you with step-by-step guidance on how to take control of your financial future.

1. Traditional IRA

When saving for retirement without access to a 401k, a Traditional Individual Retirement Account (IRA) is a strong contender. Much like a 401k, a Traditional IRA offers tax advantages that can help your retirement savings grow more efficiently.

To make the most out of this financial instrument, there are specific steps you should follow—ranging from understanding eligibility criteria to knowing contribution limits and deadlines. Let’s walk through each one.

Step 1: Eligibility Criteria

Nearly anyone with earned income can contribute to a Traditional IRA. The key requirement is to earn income for the year you contribute. Keep in mind there are deductibility limitations depending on your modified adjusted gross income (AGI) for the year. These income limitations may have an impact on your tax benefits.

Step 2: Opening an Account

You can approach financial institutions like banks or brokerage firms to set up a Traditional IRA. The process usually involves filling out an application, providing identification, and deciding on your initial contribution.

Step 3: Contribution Limits and Deadlines

The contribution limit is $6,500 For 2023 for individuals under 50 and $7,500 for those 50 or older. Contributions can generally be made until that tax year’s tax filing deadline.

Benefits

- Tax Deductible: You’ll pay ordinary income taxes on withdrawals in retirement, not when you contribute, providing upfront tax relief. (dependent upon your modified AGI for the year)

- No Wash Sales: Gives you more freedom in managing your investments.

- Tax-Free Transfers: Rolling over and consolidating old 401k accounts into your IRA typically experiences no tax penalty.

- Conversion Options: Provides the opportunity to convert pre-tax dollars into after-tax dollars in a Roth IRA. (be aware of ordinary income tax implications)

- No Income Limitations: Accessible to individuals at any income level for contributions. (tax benefits may vary)

2. Roth IRA: The Tax-Free Route

If a tax-free retirement income stream sounds appealing, a Roth IRA might be your perfect match.

Given that the 2017 Tax Cuts and Jobs Act specifies taxes will revert back to higher rates in 2026, the Roth IRA offers a timely opportunity to take advantage of contributions now for tax-free income later. Take the case of Peter Thiel, who owned PayPal in his Roth IRA when it was just a startup and ultimately grew his PayPal investment into billions today, all tax-free.

Step 1: Eligibility Criteria

To invest in a Roth IRA, you must have earned income and meet certain income limitations, which are updated annually. High-earners may not be eligible to contribute directly but can explore backdoor Roth IRA options.

Step 2: Opening an Account

Like a Traditional IRA, opening a Roth IRA involves selecting a financial institution, filling out an application, and making your initial contribution.

Step 3: Contribution Limits and Deadlines

For 2023, individuals under 50 can contribute up to $6,500, and those 50 or older can contribute up to $7,500. Contributions are allowed up to the last date of the tax filing deadline for that year.

Benefits

- After-Tax Contributions: Pay taxes now to avoid potentially higher rates in the future, especially given the rising national debt.

- No Required Minimum Distributions: Roth IRAs are not subject to the Required Minimum Distributions that apply to other retirement accounts, offering more control over your funds.

- Tax-Free Inheritance: While the account figures in your estate, beneficiaries receive tax-free funds.

- Ghost Income: Earnings grow tax-free, providing invisible income to the government during withdrawals.

- Investment Flexibility: As with Traditional IRAs, you have many investment options to grow your retirement savings.

3. SEP IRA: For the Self-Employed and Freelancers

When you are in the freelance or self-employed landscape, setting up a Simplified Employee Pension IRA can be an excellent option to save for retirement.

Unlike other individual retirement accounts, the SEP IRA stands out for its higher contribution limits and added tax benefits, making it particularly beneficial for those in a higher tax bracket.

Step 1: Eligibility Criteria

SEP IRAs are open to anyone who has freelance or self-employment income. The rules are fairly compassionate, allowing both business owners and their employees to contribute.

Step 2: Opening an Account

To open a SEP IRA, select a financial institution offering these accounts. You can then fill out an application form, provide any required documentation, and decide how much you wish to contribute initially.

Step 3: Contribution Limits and Deadlines

SEP IRAs have higher contribution limits compared to Traditional or Roth IRAs. The contribution can be up to 25% of your net earnings from self-employment but up to a certain limit defined annually by the IRS. Contributions, including extensions, can be made up to the business’s tax filing deadline.

Benefits

- Higher Contribution Limits: A standout feature for those aiming to save significantly for retirement.

- Investment Flexibility: Many investment options are available to diversify your retirement savings.

- Tax-Deductible: Contributions are deductible, reducing your modified adjusted gross income.

- Business Income Deduction: Contributions to a SEP IRA can be deducted as a business expense, further lowering your tax liability

- Age-Based Contributions: The older you get, the more you can contribute, facilitating late-stage retirement planning.

4. Real Estate: Tangible Asset Investment

Investing in real estate presents an alternative to traditional or Roth IRA accounts and mutual funds, offering both tangible assets and a range of income streams.

Whether you’re looking to diversify your investment portfolio or find a more hands-on investment approach, real estate can be a compelling avenue for long-term wealth creation.

Step 1: Research and Select Property Type

Begin by identifying the type of property you want to invest in—residential, commercial, or even vacation rentals.

Conduct market research to identify locations that offer the best return on investment. Once you’ve narrowed down your choices, collaborate with real estate professionals for deeper insights.

Step 2: Financing Options

After selecting a property, explore financing options through a bank or investment company. Whether it’s a traditional mortgage, private funding, or even leveraging your after-tax dollars from other investment accounts, a sound financing strategy can make or break your investment returns.

Step 3: Property Management and Income Streams

Upon acquisition, you’ll need to decide on the method of property management—whether to manage the property yourself or employ a property management company.

Figure out your income streams: rental income, property value appreciation, or other creative avenues like Airbnb hosting.

Benefits

- Tangible Asset: It is a physical asset, which means it provides a greater sense of security.

- Tax Deferral: Certain tax benefits, such as depreciation and 1031 exchanges, can defer tax liability.

- Diverse Income Streams: Real estate offers multiple earning ways, from rental income to capital appreciation.

- Reverse Mortgages: At age 62, when the mortgage is paid off, you can opt for a reverse mortgage to supplement retirement income, provide a long-term care plan, or secure a growing line of credit.

Leverage: With a small down payment, you can control a large asset, maximizing potential returns.

5. Stocks and Bonds: Opening a Taxable Brokerage Account

Diversifying your retirement savings continues beyond individual retirement accounts or real estate; opening up a taxable brokerage account offers another viable avenue.

When you invest in stocks and bonds in this investment vehicle, you have access to more preferential short-term and long-term tax rates.

Step 1: Understanding Risks and Rewards

Before jumping in, it’s critical to understand the risk and reward dynamics of stocks and bonds. While stocks offer higher returns, they also come with increased volatility.

Bonds are more stable but offer lower potential gains. Balancing the two based on your financial goals and risk tolerance is essential.

Step 2: Selecting a Brokerage Account

Next, you’ll need to choose a brokerage account to start trading. This could be a traditional brokerage, an online platform, or a robo-advisor.

Each has its own fee structure, features, and limitations. Make sure to select one that aligns with your investment strategy.

Step 3: Building a Diversified Portfolio

Once your account is set up, focus on building a diversified portfolio. This could range from individual stocks and bonds to ETFs and mutual funds. The goal is to spread risk while maximizing potential gains.

Benefits

- Tax Efficiency: Non-qualified investments are taxed at capital gains rates, generally at lower tax rate than ordinary income.

- Tax Harvesting: Balance gains and losses yearly, allowing up to a $3,000 loss to reduce what you pay ordinary income tax.

Diversification: The Importance of Spreading Risk

Diversification is key for risk management and tax optimization in your retirement savings. By spreading investments across assets like traditional or Roth IRAs and non-qualified options, you can safeguard against unpredictable tax scenarios.

How Diversification can Enhance your Retirement Income

Having a diversified portfolio isn’t just about risk; it’s about reward, too. Different types of assets can perform well under various market conditions, balancing out your returns.

By using tax diversification strategies and incorporating investments with varied tax implications, you can forge a more tax-efficient income stream in retirement, potentially reducing what you need to pay in income taxes.

Global Diversification

Exposure to a diverse set of investments could reduce the market risk of your portfolio. Investing solely in U.S. stocks, especially the “Magnificent 7” stocks in the U.S. Market– Netflix, Amazon, Tesla, Meta, Apple, Microsoft, and Nvidia, can be a high-risk strategy leading to increased volatility.

Broadening your investment horizons to include global investments reduces your dependency on any single market’s performance, enhancing both your risk profile and potential returns.

Conclusion

You’re far from limited when figuring out how to save for retirement without a 401k. From Traditional and Roth IRAs to investments in real estate, stocks, and bonds, there are many avenues to explore.

The key to success in retirement planning lies in diversification—across asset types, tax structures, and even geographical borders. This mitigates risk and optimizes potential returns, paving the way for a financially stable and fulfilling retirement.

If you’re ready to plan a comfortable retirement, we invite you to Request a Getting to Know You Meeting. Let’s tailor a retirement savings plan that aligns with your unique needs and maximizes your potential returns.