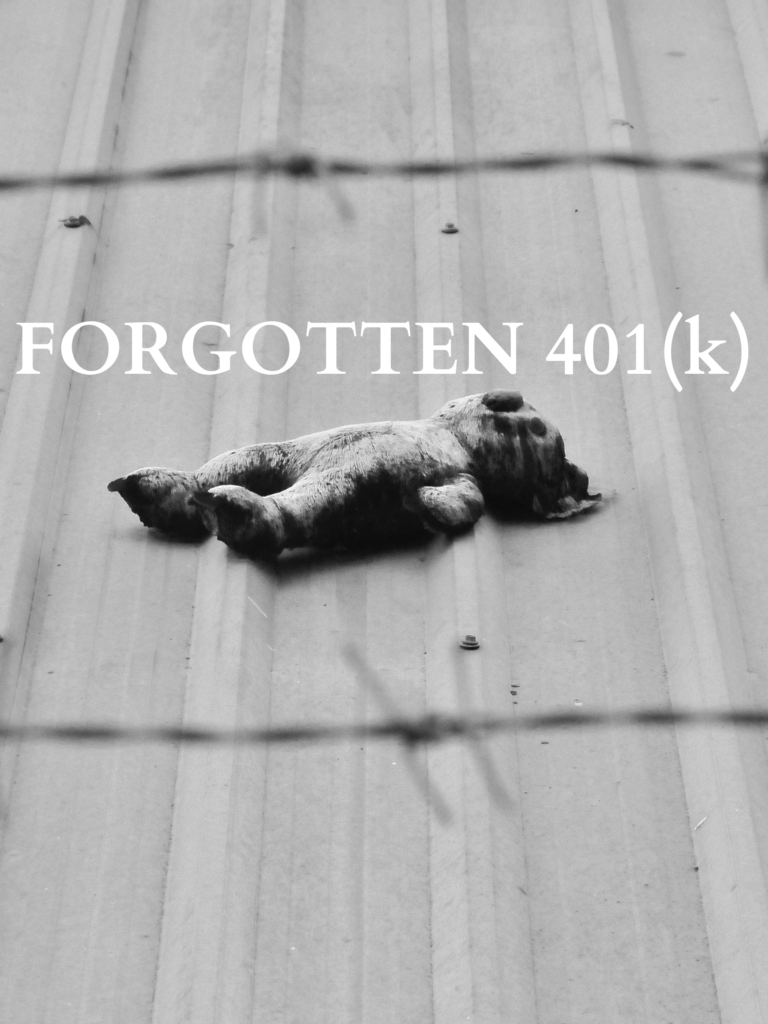

📣Attention all job hoppers 📣

Did you forget about your 401(k) account from a previous employer. Or are you currently considering rolling over your 401(k)? If so, it helps to understand the pros and cons associated with the move and some of the consequences of leaving it at a former employer.

Here are a few potential outcomes:

1️⃣ Lost Retirement Savings: If you forget about your 401(k) and don’t take any action, the funds may remain stagnant due to the management of the account. This could jeopardize the size of your retirement nest egg and opportunity from growth or investment returns.

2️⃣ Administrative Fees: Many 401k plans charge administrative fees to cover maintenance and management costs. Investment fees are usually associated with the account funds as well. If you forget about your account, you might continue incurring these fees without realizing it. This can be problematic as fees become harder to track, fees can often change and fees and vary depending on the employer plan.

3️⃣ Tax Penalties: Depending on the rules of your former employer’s plan, there may be tax penalties if you withdraw the funds prematurely or fail to rollover the account within the designated timeframe. These penalties can result in a loss of a portion of your savings, leaving you with less for retirement.

4️⃣ Difficulty in Tracking Multiple Accounts: If you have multiple 401k accounts spread across different former employers, it can become challenging to keep track of them all. This can lead to confusion, potential missed rollover opportunities, and a fragmented retirement strategy.

To avoid theses consequences, its important to stay proactive and keep track of your retirement accounts. If you’re unsure about the best course of action, seek advice from a qualified financial advisor. They can help you assess your financial goals, tax implications, and long-term investment strategies.

Here is another resource you can use to help track down your forgotten 401(k) with the Capitalize 401(k) finder!

Remember, your retirement savings are a crucial part of your financial future. By taking the right steps during a 401k rollover, you can safeguard your hard-earned money and set yourself up for a comfortable retirement. 💪💰