Introduction

Imagine keeping a significant portion of your hard-earned money away from the government. Yes, it’s possible! Every dollar saved from taxes is a dollar added to your wealth, retirement savings, or even your next vacation fund.

Taxation impacts us all, but not everyone realizes the power of effective tax strategies. Whether you’re a high net worth individual, a small business owner, or at the early stages in your professional career, understanding how to lower your lifetime taxes can lead to substantial savings. Why do we call it lifetime taxes? Because it comes at different phases of your life – taxes while you are working, taxes in retirement, and taxes at death.

This blog will introduce several tax savings strategies, showing you how tax planning, tax management, and tax preparation can work in harmony to keep more money in your pocket. Get ready to explore the benefits of tax efficiency and learn ways to save on your lifetime tax bill!

Continue reading to unlock these secrets, transform your financial future, and ensure you’re not leaving money on the table for this tax season and beyond.

Tax Preparation: The Foundation of Tax Savings

Tax preparation is the process of compiling and filing your tax returns for a certain year, but it’s also the foundation of a robust tax-saving strategy. Tax preparation services can ensure accuracy, avoid penalties, and leverage deductions and credits to your advantage. It’s not just about getting through tax season; it’s about setting the stage for lowering your lifetime taxes bill.

Effective tax preparation involves meticulous record-keeping, staying aware of tax law changes, and strategically planning deductions. A professional tax preparer or advisor can help identify opportunities for tax savings for that specific year that you might overlook, such as charitable contributions, education expenses, or home office deductions. By optimizing your tax return, you’re taking the first step towards maximizing your tax efficiency.

Tax Planning: The Blueprint for Future Savings

While tax preparation deals with your previous and current year finances, tax planning focuses on your future. It’s about creating a strategic blueprint that guides your financial decisions to minimize your future tax liabilities. Tax planning involves various strategies, from selecting the right investment vehicles to timing income and deductions for optimal tax outcomes.

Financial planning and taxes are deeply intertwined. By incorporating tax planning into your overall financial strategy, you can make decisions that reduce your taxable income, such as contributing to retirement accounts, harvesting tax deductions, or planning for large expenses. Additionally, understanding the impact of different types of income—like wages, investments, interest, or business income—can help you shape your financial landscape in a tax-efficient manner.

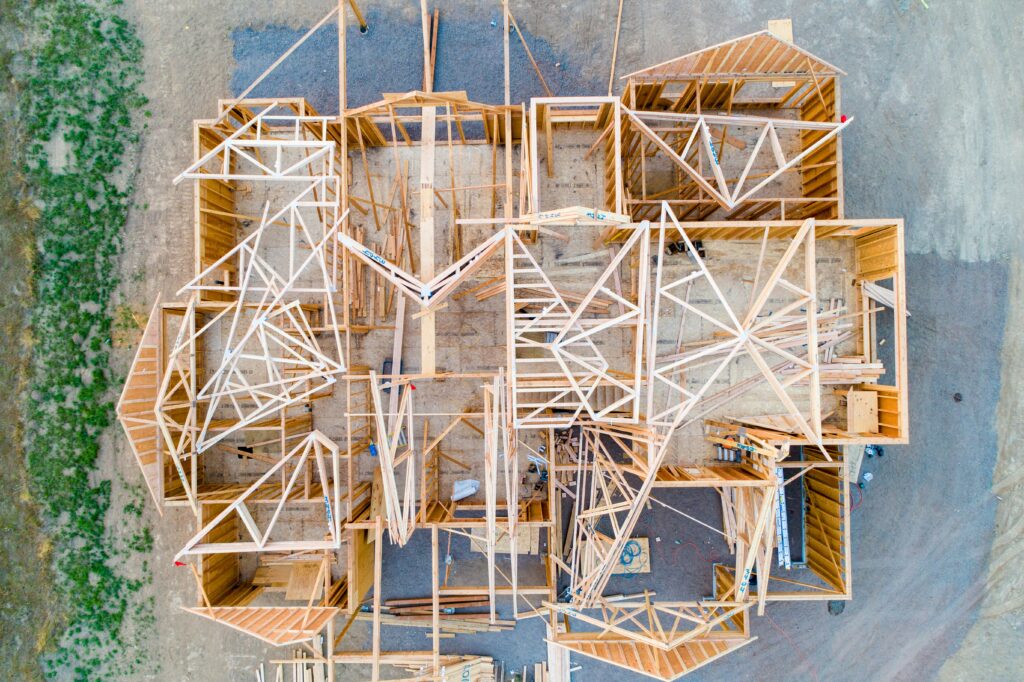

Tax Management: Maintaining and Building Your Financial House

Tax management takes the blueprint created by tax planning and turns it into reality, ensuring your financial house is built and maintained to withstand the test of time and taxes. This ongoing process involves adjusting your strategies in response to life transitions, evolving tax laws and any other life uncertainties.

Effective tax management means monitoring your investment portfolio for tax efficiency, such as leveraging the order of money to help increase your cash flow. This can be done by placing your investments in different types of accounts depending on their tax status. It also involves using asset location strategies allocating tax sensitive assets within your portfolio. Additionally, managing retirement withdrawals based on your current and future year income to minimize tax liabilities. In essence, tax management is about keeping your financial house in order, ensuring every decision contributes to your goal of lowering lifetime taxes.

The Tax Trilogy: A Coordinated Approach

The true secret to lowering lifetime taxes lies in the coordination of tax preparation, tax planning, and tax management. This tax trilogy is the holistic approach that considers not only what you make but what you keep.

Just like building a home requires a blueprint, construction, and inspection, effective tax mitigation requires planning, managing, and preparing. As your tax architect, builder, and inspector, a tax advisor specializing in these interconnected services can significantly reduce your lifetime taxes. This comprehensive approach ensures that every financial decision is made with tax efficiency in mind, from the investments you choose to the timing of your income.

Conclusion

Lowering your lifetime taxes isn’t a one-time effort but a continuous process that involves comprehensive tax preparation, strategic tax planning, and diligent tax management. By understanding and applying these principles, you can build a financial future that minimizes your tax liabilities and maximizes your wealth.

Don’t let taxes diminish your confidence. Explore more about tax savings strategies, investment management, and how The Lynch Financial Group can guide you through the complexities of taxation with professional tax advisor advice. Schedule a meeting with one of our advisors today and start building your blueprint for a more tax-efficient tomorrow. Let’s ensure it’s not just about what you make, but what you keep.