Designing an investment portfolio based upon age…

When it comes to investing, age is a critical factor. The money cycle (as mentioned in previous posts) is based heavily on the age of the investor. If the investor is younger, they are most likely in the accumulation/growth phase of their life. If they are nearing retirement, they will experience more of the preservation/distribution phase of the cycle.

Age helps determine the structure of an investment portfolio and how to properly allocate those assets between low-volatility, medium-volatility, and high-volatility investments.

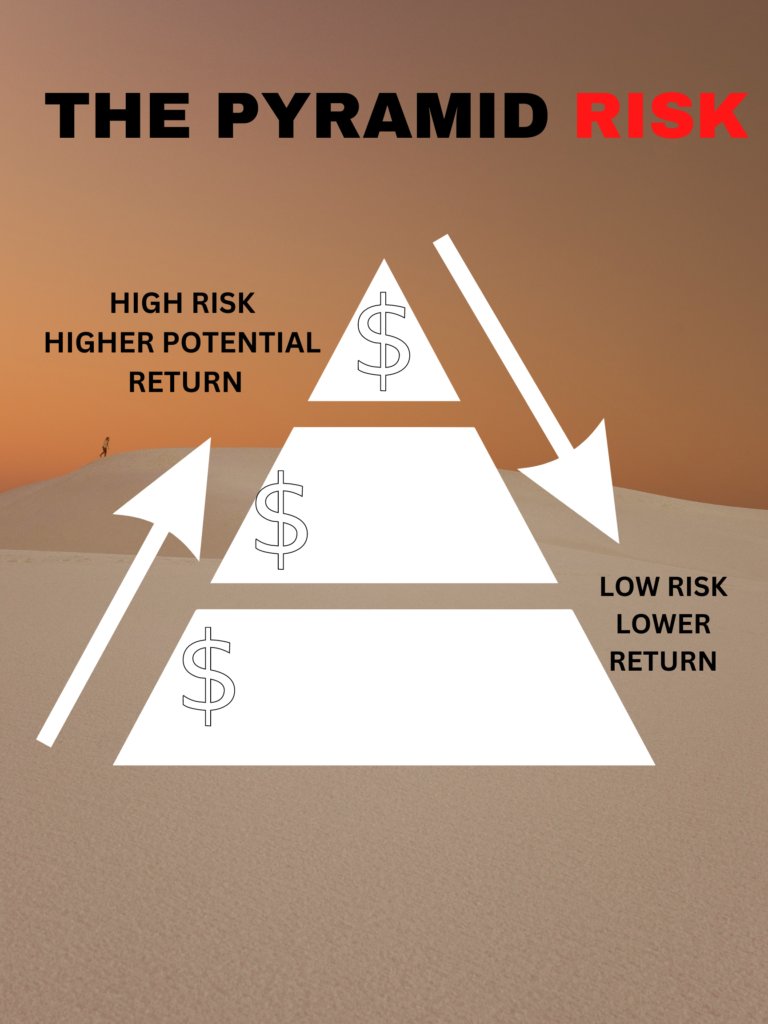

We reference a table called the “Pyramid of Risk” to help determine where to place these specific investments. The pyramid includes 3 distinct tiers: low-risk investments such as cash and money market accounts, government bonds and insurance products. Moderately risky investments like stock and bond funds tied to the market. And high-risk speculative investments like individual stocks and bonds, crypto coins, and derivatives.

The Pyramid of Risk is a great resource to use when structuring a properly diversified investment portfolio. The tiers mentioned above determine the potential risk of each set of assets and their ability to produce a certain rate of return.

For example, the higher-risk assets at the top of the pyramid have a greater chance of loss but also potential for above-average returns.

An investor’s portfolio is structured through their appetite for volatility and risk in the markets. Utilizing the different layers of the pyramid is a great way to properly allocate money to fit an investors tolerance.