Did you know that a significant portion of the workforce is heading toward retirement without the safety net of a pension?

In an era where only a small percentage of people can access pension plans, securing a comfortable retirement, especially managing a retirement account and understanding how to pay income taxes on withdrawals, becomes crucial. If this sounds like your situation, you’re not alone. Thankfully, there’s hope.

This blog post discovers how to prepare for retirement without a traditional pension. With the right strategies and advice from a financial professional, you can create a plan that works for you.

We’ll guide you through essential saving tips, including when to withdraw money wisely, tailored to your needs, and help you build a financial foundation for a fulfilling retirement lifestyle.

Ready for a worry-free retirement? Keep reading for actionable steps, and grab our free guide for more insights.

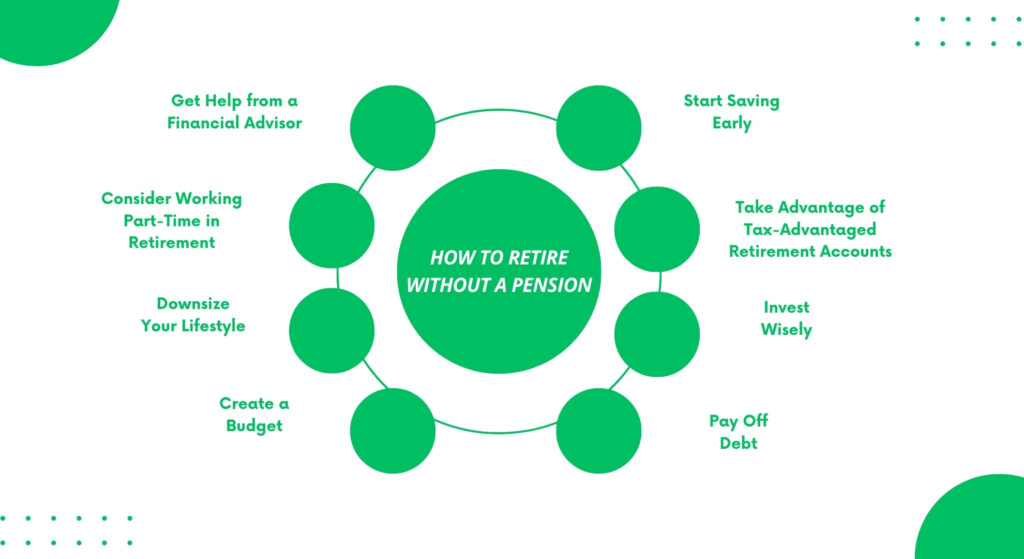

How To Retire Without a Pension? Step-by-step

Retiring without a pension isn’t just possible—it’s the reality for many. As traditional pension plans become scarcer, exploring alternative routes to secure retirement is crucial.

This guide offers practical steps for building financial stability without relying on a pension, highlighting the importance of early savings in individual retirement accounts (IRAs), making wise investments in tax-advantaged accounts, and managing debts effectively.

These strategies are key to maximizing your resources, including exploring tax-deductible options and considering the benefits of tax-free retirement solutions. Whether you’re just starting your career or nearing retirement age, these methods offer a clear path to a comfortable retirement.

Building retirement security means enjoying your later years to their fullest, thanks to strategic planning.

1. Start Saving Early

Beginning your savings journey as early as possible is the foundation of building a substantial retirement fund. The longer your money is invested, the more opportunity it has to grow through compounding returns.

This means that your money’s interest or investment returns start earning its own return. Starting in your 20s or 30s can significantly impact you, but it’s never too late to begin.

Prioritize setting aside a portion of your income for retirement, even if you start with a small amount.

2. Take Advantage of Tax-Advantaged Retirement Accounts

Taking advantage of tax-advantaged retirement accounts is a smart move for growing your savings. By contributing to traditional 401(k)s and individual retirement accounts (IRA), you can reduce your taxable income in the year those contributions are made, which leads to immediate tax savings.

This highlights the difference between tax-deferred accounts, which pay taxes upon withdrawal, and tax-free accounts like Roth IRAs and 401(k)s. With Roth accounts, your money grows tax-free, and you don’t pay taxes when you withdraw in retirement, making them an excellent choice for future income without the tax burden.

Understanding how to use these accounts strategically can significantly impact the size of your retirement savings and when and how you’ll pay taxes on your hard-earned money.

3. Invest Wisely

Investing your savings is crucial for outpacing inflation and building wealth over the long term. A diversified investment portfolio can help balance risk and return, ideally including a mix of stocks, bonds, and other assets tailored to your risk tolerance and investment horizon.

As you get closer to retirement, move your investments into safer options to keep your savings secure. Regularly review and adjust your investments to align with your retirement goals.

4. Pay Off Debt

Reducing or eliminating debt before retirement can significantly lower your monthly expenses and financial stress. High-interest debt, like credit card balances, should be prioritized due to its cost.

As you move closer to retirement, also work towards paying off mortgages and car loans. Entering retirement debt-free means more savings can be used for living expenses and leisure rather than servicing debt.

5. Create a Budget

A clear understanding of your retirement expenses is essential for effective planning. Itemize your expected costs in retirement, including fixed expenses (housing, healthcare, utilities) and variable expenses (travel, hobbies). This detailed budget will help you estimate the savings needed for retirement and identify potential areas for cost reduction.

6. Downsize Your Lifestyle

Adjusting your lifestyle to fit a more streamlined budget can extend your retirement savings. This might involve moving to a less expensive home or area, reducing discretionary spending, and finding more affordable ways to enjoy hobbies and travel. Embracing a simpler lifestyle can lead to significant savings without sacrificing quality of life.

7. Consider Working Part-Time in Retirement

Part-time work during retirement keeps you socially engaged and mentally active. Explore opportunities that match your skills or passions, such as consulting, teaching, or coaching. Certain studies have shown that retirement is not as glorious as the movies make it seem. Riley Moynes, a writer and public speaker, conducted a study on retirement and found from his results that there are 4 Phases of Retirement.

“The vacation is the fun part. At least that’s the stereotype for older workers who are eager to give up the pressures of work and a rigid schedule and look forward to a more relaxing way of life. But the perennial vacation quickly gives way to Phase 2: a feeling that, without work, life lacks purpose. This phase can be depressing and even traumatic, Moynes said. So you have been warned.”

8. Get Help from a Financial Advisor

A financial advisor can be invaluable in navigating the complexities of retirement planning without a pension. They can offer personalized advice on saving strategies, investment choices, and retirement income planning.

They can assist with tax planning and estate planning, ensuring you’re making the most of your financial resources for a secure retirement.

Who is Likely to Retire Without a Pension?

Retiring without a pension is becoming more common as the landscape of retirement savings shifts. While pensions used to be a key to retirement planning, changes in employment practices and the rise of alternative retirement savings plans have left many without this traditional safety net.

Individuals most likely to face retirement without a pension often fall into specific categories due to their employment background, savings habits, or life circumstances. Here’s a look at who might be navigating retirement without the benefit of a pension:

- Self-Employed Professionals: Many entrepreneurs and freelancers prioritize business growth over personal retirement savings, lacking employer-sponsored pension plans.

- Small Business Employees: Small businesses often don’t offer pension plans due to the high costs of setting up and maintaining these benefits.

- Workers in Industries Dominated by Gig or Contract Work: Sectors like technology, creative industries, and construction, where short-term contracts and freelance work are standard, rarely offer pensions.

- Employees of Companies That Have Phased Out Pension Plans: Some workers may have started their careers with pension promises, only to see those plans frozen or terminated as employers shifted to defined-contribution plans like 401(k)s.

- Individuals Who Change Jobs Frequently: People who move between jobs or careers frequently may miss out on vesting in employer-sponsored pension plans, leaving them without this source of retirement income.

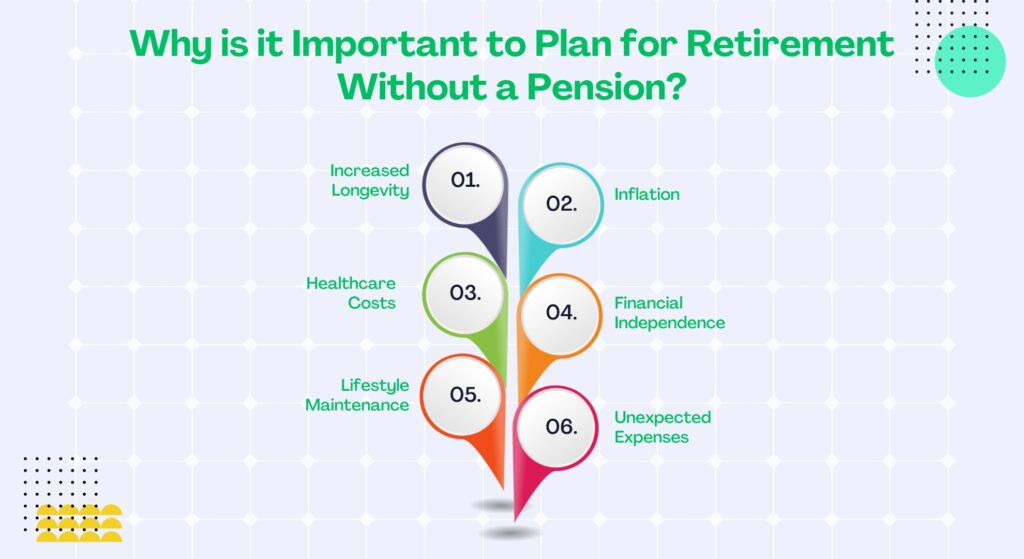

Why is it Important to Plan for Retirement Without a Pension?

Planning for retirement without a pension is increasingly essential in today’s economic climate. As the availability of traditional pension plans continues to decline, individuals are responsible for securing their financial future for their retirement years.

Here are several reasons why it’s critical to plan for retirement without relying on a pension:

Increased Longevity

Advances in healthcare mean people are living longer, which translates to a longer retirement period that needs to be funded. Without a pension, you must ensure your savings can support you for 20 to 30 years after you stop working.

Inflation

The cost of living tends to rise over time, and without a pension providing a steady income stream, your savings must be sufficient to cover increasing expenses. Planning ensures that your purchasing power is protected as inflation impacts the economy.

Healthcare Costs

One of the most significant expenses in retirement is healthcare. Without a pension, you need to have a plan to cover medical costs, including long-term care, which can reduce savings quickly if not anticipated.

Financial Independence

Relying solely on Social Security or other government benefits is risky, as these programs may face benefits or eligibility requirements changes. Planning for retirement without a pension allows you to maintain control over your financial independence and security.

Lifestyle Maintenance

Having a robust financial plan is essential to enjoy the same standard of living in retirement as you did during your working years. Without a pension, saving and investing wisely becomes crucial for leisure activities, travel, and other lifestyle choices.

Unexpected Expenses

Retirement can bring unforeseen costs, such as emergency repairs, helping family members financially, or facing sudden health issues. A well-thought-out retirement plan can provide a safety net for these unpredictable events.

Additional Tips for Optimizing Your Retirement Savings

Optimizing your retirement savings is crucial for ensuring a financially secure and comfortable retirement, especially without a traditional pension plan. Here are more tips to help you grow your retirement savings and make sure you have a steady income during your retirement:

1. Start an Emergency Fund

Before aggressively saving for retirement, establish an emergency fund to cover unexpected expenses. This stops you from spending your retirement savings during tough financial times, ensuring the money is there for its true purpose.

2. Automate Your Savings

Set up automatic transfers to your retirement accounts to make saving effortless. Automating contributions can help you stay consistent and maximize compound interest over time.

3. Increase Savings Rates Over Time

As your income grows, increase the amount you save for retirement. Even small incremental increases can significantly impact your savings over time.

4. Take Full Advantage of Employer Match

If you can access an employer-sponsored retirement plan like a 401(k), ensure you contribute enough to qualify for the full employer match. This is essentially free money that can boost your retirement savings.

5. Diversify Your Investments

A well-diversified investment portfolio can help manage risk and tap into different growth opportunities. Consider a mix of stocks, bonds, mutual funds, and other investments aligned with your risk tolerance and retirement timeline.

6. Consider Health Savings Accounts (HSAs)

If you have access to an HSA and are in good health, consider using it as a retirement savings tool. HSAs offer triple tax advantages, and funds can be used tax-free for qualified medical expenses in retirement.

7. Consult with a Financial Planner

A qualified financial planner can provide personalized advice tailored to your unique financial situation, helping you navigate complex decisions and optimize your retirement savings strategy.

Conclusion

Retiring without a pension is increasingly common in today’s employment landscape, but a comfortable retirement is still achievable with careful planning and strategic actions.

Key steps include saving early, taking advantage of tax-advantaged retirement accounts, investing wisely, paying off debt, creating a budget, downsizing your lifestyle, considering part-time work in retirement, and seeking advice from a financial advisor.

These strategies can help ensure that your retirement years are financially secure, allowing you to enjoy this period of your life to the fullest.

Start evaluating your current financial situation and take the necessary steps today to secure your future. Whether you’re decades away from retirement or nearing it, it’s never too late to improve your retirement outlook. Consider consulting a financial advisor to tailor a retirement plan that best suits your needs and goals.

Frequently Asked Questions (FAQs)

How do people retire with no pension?

People retire without a pension by maximizing contributions to tax-advantaged retirement accounts, investing in diversified portfolios, reducing expenses and debt, exploring alternative income sources like insurance products or rental income, and delaying Social Security benefits to increase monthly payouts.

These strategies help build a sustainable retirement income without relying on a traditional pension plan.

What is the safest place to put my retirement money?

A safe place to put your retirement money often includes low-risk investments such as treasury bonds, insured savings accounts, fixed annuities, and money market funds. While these options typically offer lower returns, they provide greater security for your capital, making them suitable for the portion of your retirement savings you cannot afford to lose.

Can you retire with just a 401(k)?

Yes, you can retire with just a 401(k), significantly if you consistently contribute to it throughout your career, take advantage of employer matching, and invest wisely. However, diversifying your retirement savings with other accounts and investments is often recommended for additional security, potential growth and tax diversification.