Introduction

Imagine entering your golden years with peace of mind, knowing your finances are secure, allowing you to enjoy your retirement to the fullest. This isn’t just a dream—it can be your reality with the right planning.

As we step into 2024, the economic landscape continues to evolve, bringing new challenges and uncertainties to retirees. Understanding how to turn your financial uncertainties into certainties, such as a retirement annuity plan, is more crucial than ever.

In this post, we will explore the compelling reasons why securing the best retirement annuity plan should be a top priority for anyone looking to protect their financial future. From battling inflation to ensuring a steady income stream, the benefits are clear.

Read on to discover how choosing the best retirement annuity plan in 2024 can help you manage certain financial risks and achieve a more confident retirement.

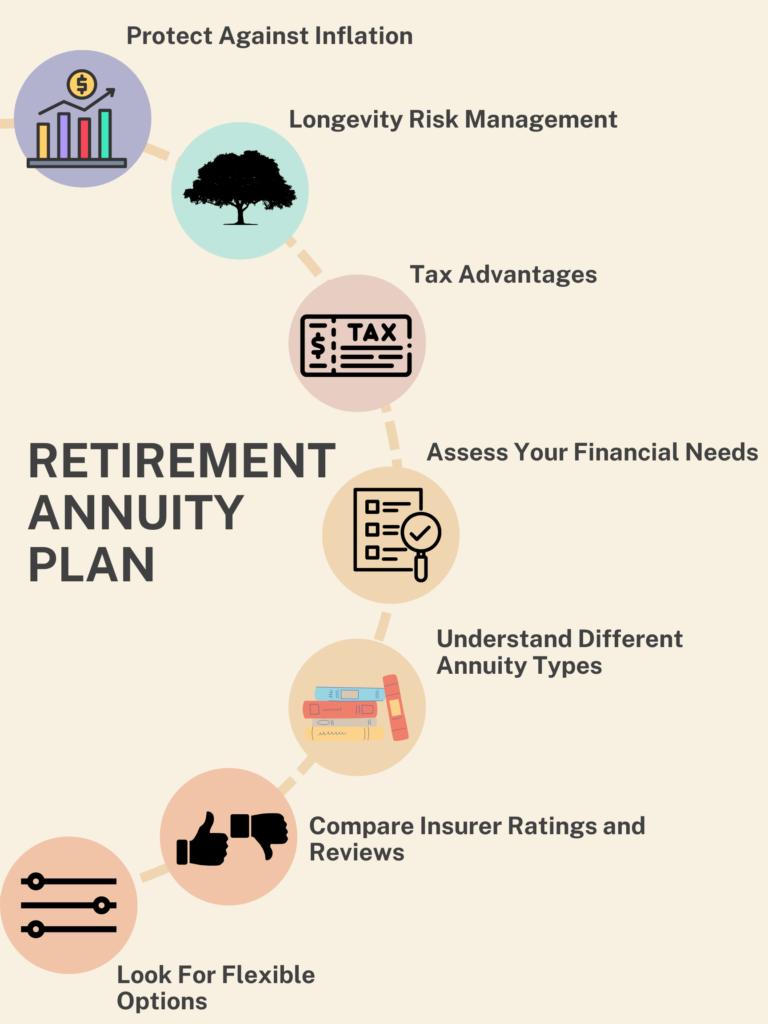

Why You Need a Retirement Annuity Plan in 2024

The landscape of retirement is changing, and with it, the strategies to ensure financial stability in your later years must evolve.

Recently, interest rates have rapidly risen to historical highs, leading to more attractive opportunities in the fixed income and insurance space. A retirement annuity plan offers a guaranteed income stream, typically for the rest of your life, making it a cornerstone of a robust retirement strategy.

Protection Against Inflation

With the unpredictable nature of inflation, especially evident in recent years, having an income that adjusts and potentially increases over time is invaluable. Certain annuity plans are designed to combat inflation, offering increases in income payments to help maintain your purchasing power as the cost of living rises. For more information on how fixed annuities can help, visit the National Association for Fixed Annuities.

Longevity Risk Management

One of the biggest fears for retirees is outliving their savings. Annuities mitigate this risk by providing a steady income regardless of how long you live. This feature removes the fear of running out of money in retirement. Learn more about managing longevity risk with annuities at Protected Lifetime Income.

Tax Advantages

Funds invested in an annuity benefit from tax-deferred growth. Upon making withdrawals, the initial investment is not subject to taxes, while the earnings are taxed at your standard income tax rate.

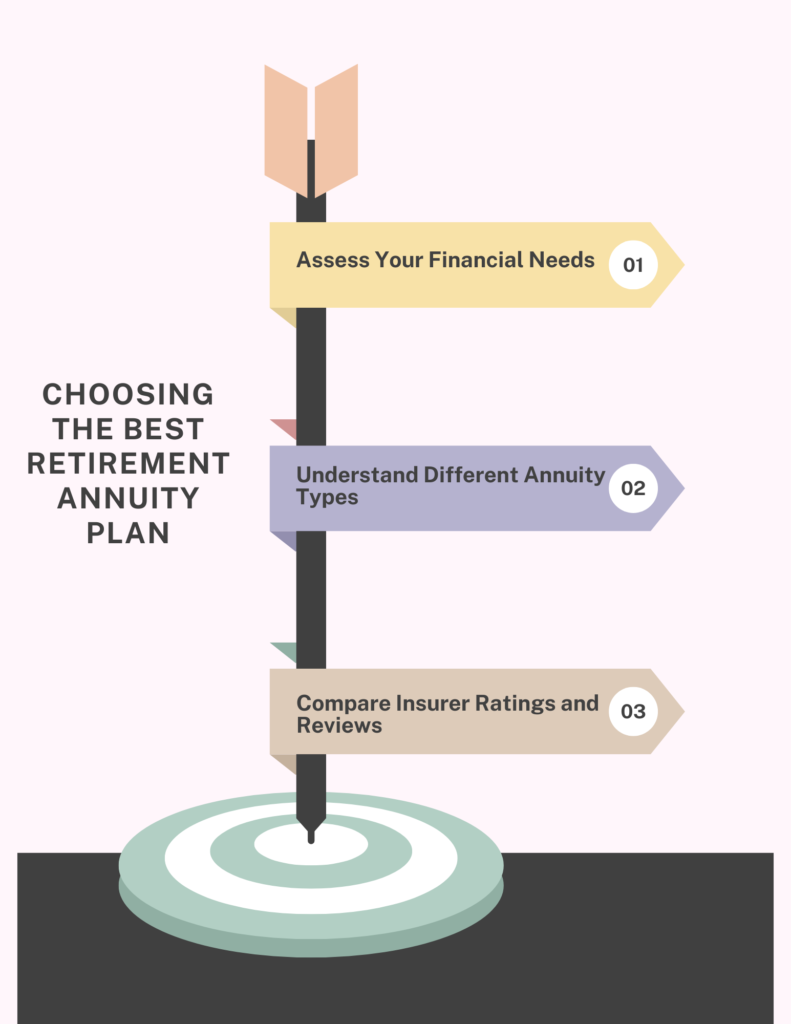

Choosing the Best Retirement Annuity Plan in 2024

Selecting the right annuity plan is vital for ensuring it aligns with your retirement goals and financial situation. Here are some tips to guide you:

Assess Your Financial Needs

Consider your expected expenses in retirement and any other income sources. This assessment will help determine how much monthly income you’ll need your annuity to generate.

Understand Different Annuity Types

There are various types of annuities—fixed, variable, and indexed—each with unique features and benefits. To better understand indexed annuities, check out Indexed Annuity Leadership Council.

Compare Insurer Ratings and Reviews

An annuity is only as reliable as the company that issues it. Check the financial strength and customer service ratings of different insurers at AM BEST to ensure they can meet their long-term obligations.

Look for Flexible Options

Imagine stepping into a delightful sandwich shop, where you have the power to customize your perfect sandwich to satisfy your unique taste buds. Similarly, when it comes to planning your retirement, you have the opportunity to personalize your financial strategy with a tailored annuity product.

Some annuities offer riders or additional features, like death benefits or withdrawal options, which can be tailored to your needs. These features, however, might come at an additional cost, so weigh their benefits carefully.

Conclusion

A retirement annuity plan in 2024 is not just a wise choice—it’s a crucial element for anyone looking to secure a financially stable retirement. By providing protection against inflation, longevity risk, and offering tax advantages, annuities can play a pivotal role in your financial planning.

Don’t wait to secure your financial future. Explore your options for the best retirement annuity plan today and consider scheduling a quick Getting To Know You Call with one of our experienced advisors at TheLynchFinancialGroup.com to personalize your retirement strategy.

Frequently Asked Questions (FAQs)

How much does a $100,000 annuity pay per month?

The monthly payout from a $100,000 annuity depends on several factors, including the type of annuity, the age at which you start receiving payments, and current interest rates. For a typical fixed annuity, starting payments at age 65, you might expect to receive between $500 and $600 per month. However, this can vary widely based on the specifics of your contract and the payout options you choose.

Are annuities better than CDs?

Annuities and Certificates of Deposit (CDs) serve different financial purposes and needs. CDs are generally safer for short-term savings, offering fixed interest rates and FDIC insurance. Annuities, on the other hand, provide long-term financial security with potential income for life, which can be more advantageous for retirement planning. Choosing between them depends on your financial goals, risk tolerance, and investment timeline.

Who should not buy an annuity?

Annuities are not suitable for everyone. Individuals who need high liquidity, those with a short life expectancy, or those already having sufficient income to cover retirement expenses might not find annuities beneficial. It’s crucial to evaluate your financial situation and retirement goals before deciding to invest in an annuity.

Do the rich invest in annuities?

Wealthy individuals may invest in annuities as part of a broader wealth management strategy, particularly for the benefits of income diversification and tax deferral. Annuities can also be used effectively for estate planning purposes, ensuring a steady income stream for heirs or funding trusts in a tax-efficient manner.