You are currently experiencing the money cycle and you may not even know it…

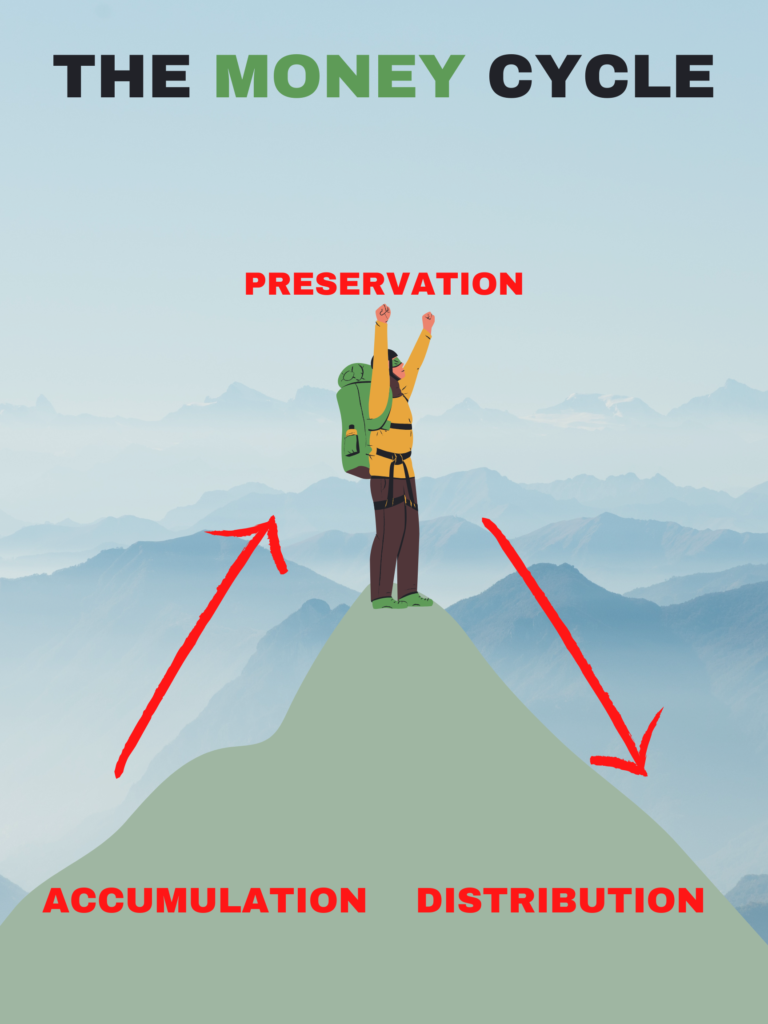

The average person goes through three phases in their lifetime. It includes Accumulation, Preservation, and Distribution phases.

The Accumulation phase is the period when you build your life savings. This can be through a company retirement savings plan such as a 401(k), 403b, IRA, etc.

As you get closer to retirement, you must preserve your life savings and protect it from volatility in the market as you will need to access that money soon. This is called the Preservation phase.

Lastly, is the Distribution phase. This is when you will tap into your savings to fund your retirement lifestyle. This money is considered your “retirement paycheck” and the income you are supposed to live on for the rest of your life.

BEWARE. The one common mistake people make, is skipping the Preservation phase of the money cycle. They grow their money up until retirement and then begin to distribute that money without regard to the impact of market volatility and the sequence of returns risk.

As we discussed in previous posts, these two concepts can severely damage your retirement savings and leave you with the risk of running out of money during your retirement!!

The Money Cycle

Corey Shevlin

Corey serves as an investment adviser representative and handles the investment related administration for The Lynch Financial Group. He currently holds his Series 65, Life and Health Insurance licenses. He attended the University of Delaware and graduated with a Bachelor’s degree in Political Science and Criminal Justice in 2019.