Introduction

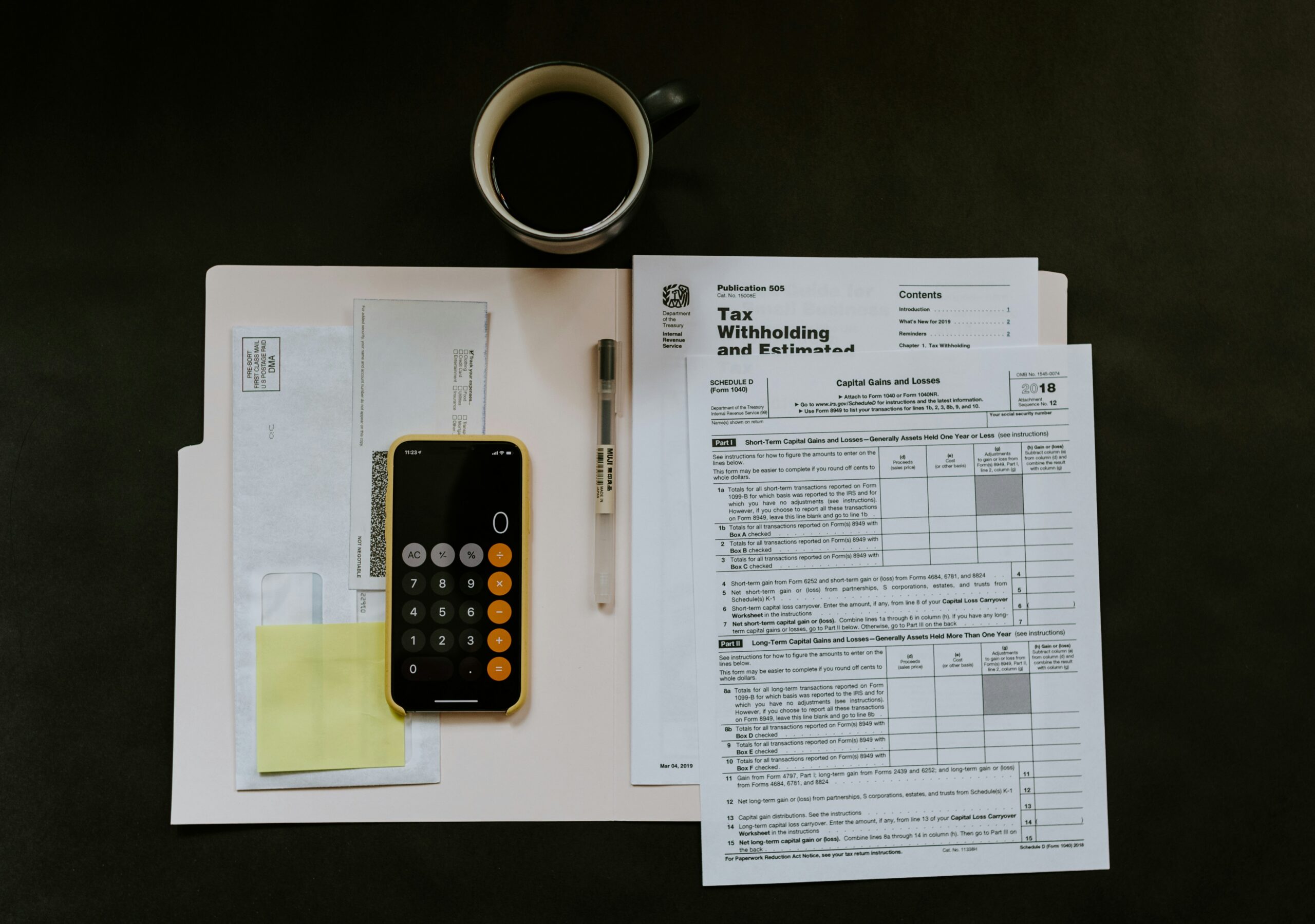

Are you navigating the complex world of online sales and wondering about the tax implications? You’re not alone. With the surge of digital entrepreneurship, understanding how taxes apply to your online income is crucial for financial success.

From side hustles on Etsy to full-fledged e-commerce businesses, online selling has become a cornerstone of modern entrepreneurship. However, the tax landscape can be daunting for many. Fear not! This comprehensive guide will demystify the intricacies of tax reporting for self-employment income from online sales.

By the end of this article, you’ll have a clear understanding of your tax obligations as an online seller in 2023.

Let’s dive into the world of online sales taxation and empower you to navigate it with confidence.

Exploring Online Sales Tax Obligations

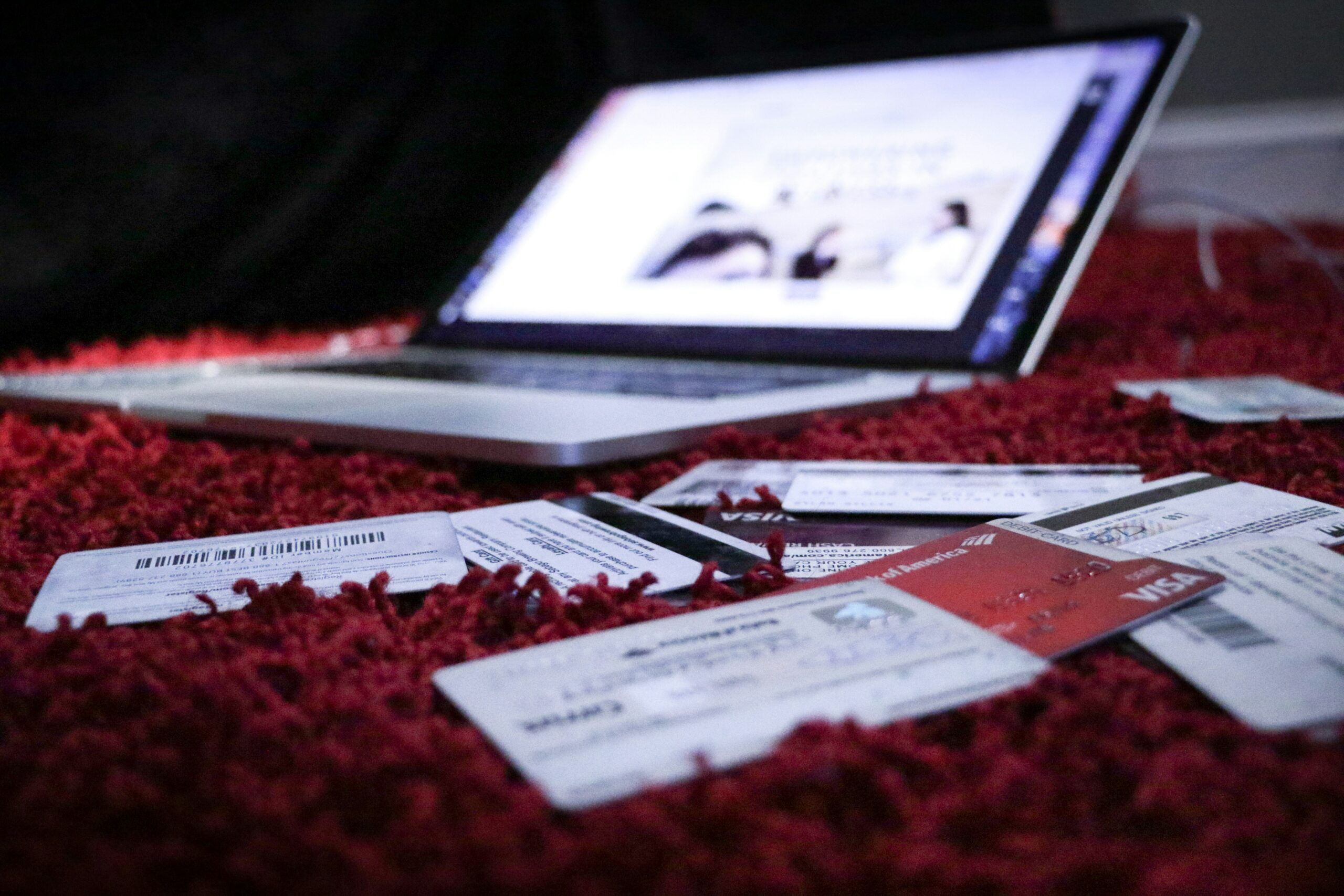

As an online seller, whether you’re self-employed or not, understanding your tax obligations is paramount. The IRS considers income earned from online sales as taxable, regardless of the platform used. Certain platforms include:

- Payment apps

- Car sharing or ride-hailing platform

- Ticket exchange or resale site

- Freelance marketplace

Payment card companies, payment apps, and online marketplaces are required to fill out Form 1099-K and send it to the IRS each year. They must also send a copy to you by January 31.

Personal payments received from family and friends should not be reported on Form 1099-K.

In 2021, a new law was passed introducing a new $600 reporting threshold for third-party merchants. However, the IRS has announced a delay in implementing this new reporting threshold. The IRS plans to set a $5,000 threshold for tax year 2024 as part of a phased approach to eventually implement the $600 reporting threshold enacted under the American Rescue Plan (ARP).

It’s essential to keep accurate records of your online sales transactions and expenses throughout the year to streamline the tax reporting process. Consider using accounting software or hiring a professional to ensure compliance with tax laws and maximize deductions.

Do I have to pay taxes on things I sell online?

Yes, in most cases, you are required to pay taxes on income earned from selling items online. Whether you’re clearing out your closet on eBay or running a thriving e-commerce store, the IRS expects you to report your online sales income and pay taxes accordingly.

Personal transactions like gifts, shared costs, or household bill payments remain non-taxable and should not be reported on Form 1099-K.

Practical Examples of Tax Obligations in Online Sales

Personal Venmo Transaction for Dinner

Let’s say Alex and Jordan had dinner together, and Jordan covered the bill. Alex later sends Jordan $30 via Venmo to pay for his share. This transaction is considered personal and is not taxable. Alex and Jordan do not need to report this on their tax returns, as it is merely a reimbursement for shared expenses.

Reselling Concert Tickets

Imagine Taylor bought a ticket to a Taylor Swift concert on Ticketmaster for $250. Due to unforeseen circumstances, she couldn’t attend and decided to sell her ticket on a resale platform for $1,000, making a profit of $750. This transaction is considered income. Taylor must report this profit on her tax return, as the IRS views it as taxable income generated from the resale of goods at a higher price than purchased.

Online Craft Sales

Emma makes handmade jewelry and sells it on Etsy. She sells over $20,000 worth of jewelry and has over 200 transactions in 2023. According to the current tax laws, Etsy will send Emma a 1099-K form because she has surpassed both the transaction and income thresholds for reporting. Emma must include the information from Form 1099-K when she files her taxes and pay taxes on her earnings accordingly.

Freelance Services on Upwork

Carlos offers graphic design services on Upwork. This year, he earned $7,000 from various clients. Since this income exceeds the $600 threshold, Carlos will receive a 1099-K form from Upwork. He must report this income on his tax return and may also deduct eligible expenses such as software subscriptions and a portion of his home internet bill.

Garage Sale Items Sold Online

Sophia decides to declutter her home and sells her old furniture and clothes online, earning $800. If this is a one-time garage sale and Sophia sold items for less than what she originally paid, she typically wouldn’t have to report this as income. However, if Sophia regularly sells personal items at a profit, this could be considered a business activity, and she may need to report these earnings.

High-Volume Dropshipping Business

Michael runs a dropshipping business through a Shopify store. In 2023, he made $150,000 in sales. Shopify, as the payment processor, will issue a 1099-K form for Michael’s business because his earnings vastly exceed the minimum threshold for reporting. Michael must report this as income and can also deduct business expenses such as website hosting fees, marketing costs, and purchase costs of goods sold.

These examples illustrate the range of scenarios that online sellers may encounter. Whether you’re involved in casual, one-off sales or running a full-scale online business, it’s crucial to understand your tax obligations and report your income accurately to remain tax compliant.

Strategies for Maximizing Profits

While taxes are inevitable, there are several strategies you can employ to maximize your profits as an online seller while remaining compliant with tax laws. Here are some tips:

Keep meticulous records: Maintain detailed records of your online sales transactions, including income, expenses, and inventory. This will simplify the tax reporting process and ensure accuracy.

Take advantage of deductions: Deductible expenses, such as shipping costs, advertising fees, and home office expenses, can help reduce your taxable income. Be sure to claim all eligible deductions to minimize your tax liability.

Consider quarterly estimated taxes: If you expect to owe $1,000 or more in taxes from your online sales income, consider making quarterly estimated tax payments to avoid underpayment penalties.

Consult a tax professional: Tax laws and regulations can be complex, especially for online sellers. Consider consulting a tax professional or accountant who specializes in small business taxes to ensure compliance and maximize tax savings.

Conclusion

In summary, understanding the tax implications of selling online is essential for self-employed individuals and hobbyist sellers alike. By familiarizing yourself with tax rules, keeping accurate records, and employing strategic tax planning strategies, you can navigate the world of online sales taxation with confidence and maximize your profits in 2023 and beyond.

Ready to take control of your online sales taxes? Explore our website at TheLynchFinancialGroup.com for more resources on tax planning strategies and schedule a consultation with one of our advisors today. Don’t let tax worries hold you back from achieving your entrepreneurial goals!