A 60-day rollover and a direct transfer are two different ways to move retirement funds from one account to another without triggering a taxable event.

A 60-day rollover is a type of withdrawal from a retirement account, such as an IRA or 401(k), in which the account holder takes possession of the funds, but then must deposit the same funds into another eligible retirement account within 60 days. This type of rollover allows the account holder to temporarily access the funds without incurring taxes or penalties, as long as the funds are redeposited within the 60-day period. However, the IRS limit one rollover per year for Traditional IRA.

A direct transfer, also known as a trustee-to-trustee transfer, is a type of movement of funds between retirement accounts in which the money is transferred directly from one financial institution to another, without the account holder ever taking possession of the funds. This type of transfer is not subject to the 60-day rollover rule and can be done as often as the account holder wishes.

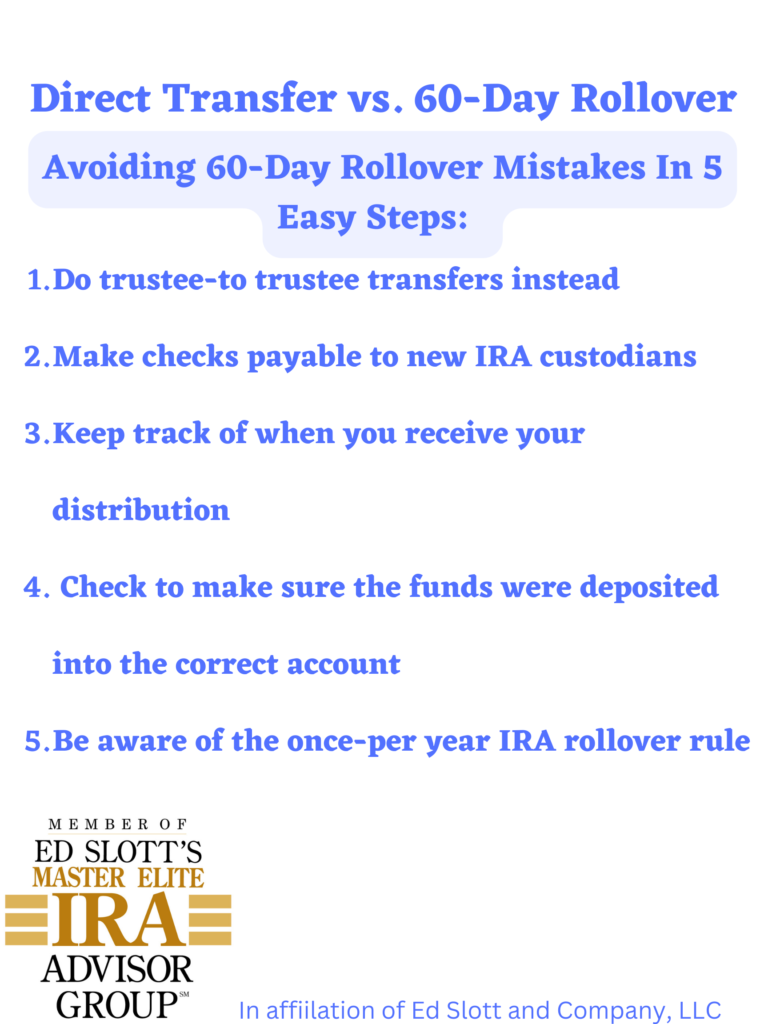

Be aware that 60-day rollovers can get hairy and end up being very costly towards the account holder. To avoid 60-day rollover mistakes, follow these easy 5 steps to prevent a detrimental impact to the value of the funds…

Check out Ed Slott and Company, LLC website for more helpful resources!